The finance function concentrates on managing the firm's financial assets, such as cash, stocks, bonds, real estate and other investments. The goal is to maximize the return on these financial assets. To determine if the firm is getting the best return on its investments, the finance function depends on a considerable amount of information from sources external to the firm.

The accounting function focuses on

maintaining and managing the firm's financial records (e.g.,

receipts, disbursements, depreciation, payroll) to account

for the flow of funds in a firm. After the financial

scandals of early 2000 (e.g., Enron), many government

regulations such as the Sarbanes-Oxley (SOX) Act drive the

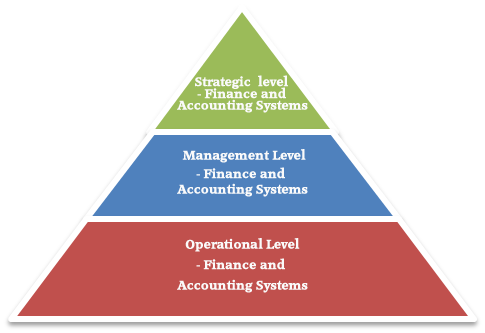

accounting practices. F&A systems exist at several levels in

organizations. Operational systems in F&A track the flow of

funds in the firm through transactions such as paychecks,

payments to vendors, securities reports, and receipts. At

the management level, F&A information systems help managers

oversee and control the firm's financial resources.

Strategic-level systems for F&A establish long-term

investment goals for the firm and provide long-range

forecasts of the firm's financial performance.